The Coming Digital Fiat Panopticon: How To Opt Out Of Financial Slavery And Become A Sovereign Individual

Central Banks around the world are busy studying and preparing to launch their own digital currencies. These digital fiat coins are commonly referred to as Central Bank Digital Currencies, or CBDCs for short.

You might be wondering what this means for cryptocurrencies and if these Central Bank coins are a threat to the nascent, rapidly growing Blockchain Ecosystem.

The idea of CBDCs is hardly new. The concept was first suggested by American economist James Tobin in 1987.

It might surprise you that the CBDC idea is that old, but it simply goes to show that our current financial system is like an ossified dinosaur - ripe for change.

Is it any wonder that the legacy financial system runs on technology from the 1960‘s and the 1970‘s?

Even though the concept of a CBDC has been technologically feasible for at least two decades, nothing happened at all until Satoshi Nakamoto, with a single new idea, practically forced governments to respond.

Let‘s examine CBDCs and their implementation in more detail.

It‘s important to understand that CBDCs are the most powerful weapon in the government‘s war against freedom. They are simply a totalitarian nightmare.

Privacy is essential to autonomy and the protection of human dignity.

It is a fundamental human right.

Privacy establishes boundaries and protects us from unwarranted interference in our lives. Privacy lets us decide who we are and how we want to interact with the world around us.

It‘s crucial to protect us from arbitrary use of force by governments, companies and anyone else who might want to exert control over us.

Privacy is the root of all other rights, such as property rights, for example.

The common argument “if you have nothing to hide, you have nothing to fear“ literally stems from Nazi Minister of Propaganda Joseph Göbbels. And we all know how that ended...

CBDCs are an orwellian, digital panopticon, completely destroying all privacy. They allow the government to track literally everything you do.

Everything you own and every single one of your transactions will be known.

What you buy, where you buy it, from whom you buy it. Whom you transfer money to.

With CBDCs, every single transaction happens directly within the government‘s database. Big Brother is always watching and you‘ll have zero privacy. (“And you‘ll be happy.“ as sociopath Klaus Schwab would add here.)

However, no longer being able to keep certain purchases or relationships private will be the least of your concerns.

If you don‘t go along with the party line, and instead take off your blinders - and god forbid think for yourself - you will eventually be labeled a dissident.

CBDCs make it trivial to target political enemies. The silencing anyone questioning the status quo is only a matter of time.

CBDCs are also a nifty tool when it comes to taxation.

No longer will you be required to calculate or file anything. Your friendly government already knows everything about your finances and will simply debit its “fair share“.

Beyond taxation, governments will use CBDCs for behavioral economics. They can literally airdrop stimulus money to certain demographics or economic sectors.

CBDCs allow for directed consumption, making money valid only for certain products or services.

And on the flip side, they can enforce financial penalties for disapproved behavior.

“Sorry. No more meat for you this month. We have debited a $50 fine from your account. We suggest you buy an approved meat replacement made from sustainable insect protein instead.“

With CBDCs, money can also turn into vaporware with negative interest rates or simply disappear entirely if not spent before a certain deadline.

Even investment can be directed at will. You could be forced to put a percentage of your savings into bankrupt asset classes like government bonds.

In other words, it‘s fascism on a whole new level. Fascism on steroids.

An economy grows by the formation of capital. This only happens at scale in a relatively free and stable market where participants act in their own self-interest.

CBDCs hardly offer a stable environment. In fact, all this interference will lead to increased volatility. And the second order economic consequences are hard to predict.

One thing is guaranteed though: Such extensive and deep manipulation of the economy is a ticking time-bomb and will have disastrous consequences sooner rather than later.

With the characteristics described above, you can already see the outlines of a social credit system like we already have in China.

This system tracks individuals everywhere via facial recognition, automatically applies fines for misdemeanors and completely shuts out non-conformists from regular society and travel.

Vaccine passports (that were planned in April 2019, way before the scamdemic) are an early version of the social credit system.

They institute access and movement control based on arbitrary government rules. CBDCs will then add the monetary aspect to this control system.

That there is a majority of people that blindly or even willfully goes along with such a scheme just goes to show that the average person is retarded. Welcome to the planet of the apes.

But I digress...

All this interference will undoubtedly lead to epic disasters and crises. Which brings me to the next great CBDC feature: Haircuts and bail-ins.

“No worries. It‘s all for the greater good. Your money will help to rebuild our great society. And if you don‘t play along, we can simply turn off your money.“

I‘ve already given you a long list of why CBDCs are a terrible idea and I haven‘t even talked about the biggest stealth wealth confiscation weapon in the arsenal of Central Banks:

Inflation.

Of course, CBDCs make it trivial to inflate the money supply and sneakily rob you of your purchasing power.

Inflation is already at record levels (see The Dollar‘s Dark Secret) and CBDCs will only make things worse.

This review wouldn‘t be complete without talking about the ultimate black swan:

The CBDC getting hacked.

The more centralized a system is, the more vulnerable it becomes.

Governments are primarily two things: malicious and incompetent. I don‘t think the world‘s best software engineers are working for governments. Quite the opposite.

Someone hacking this system and crediting themselves with billions of dollars unnoticed would be a relatively harmless scenario.

The real risk is a competent hacker destroying the entire system. The Mr. Robot scenario.

Admittedly, such a scenario is unlikely, but chances are non-zero for such an event to occur.

CBDCs are the worst possible form of money one can think of.

It‘s up to every single one of us to fight this terrible idea by opting for the antidote: Decentralized cryptocurrencies that bestow financial sovereignty.

But before we get to the alternatives and what‘s happening in the Blockchain Ecosystem, let‘s examine the current status of CBDCs around the world.

The State Of Fiat Coins Around The World

The undisputed leader when it comes to CBDCs is the Chinese Communist Party (CCP).

Very early on, the CCP actually had the foresight to recognize the threat a permissionless, uncensorable financial system presents to their social order.

And if there is one thing in the world the CCP cannot risk, it‘s a lack of social stability.

Development of China‘s CBDC started all the way back in 2014!

Where were you when it comes to cryptos in 2014?

Chances are 90% of you reading this had no clue that cryptocurrencies even existed back then.

In other words, China has been on this case extremely early and enjoys a multi-year lead over any other Central Bank.

Furthermore, China has the advantage of one of the highest mobile payment penetrations in the world. Over 776 million Chinese (54% of the population) are already using their smartphones to make payments.

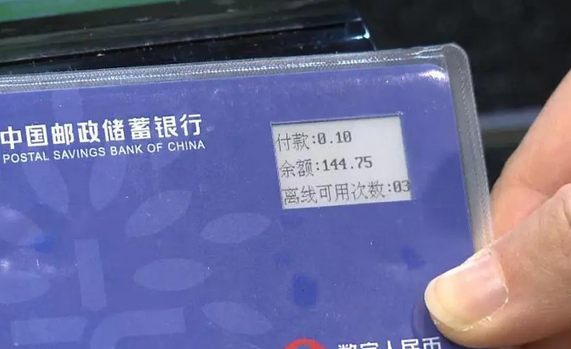

The People‘s Bank of China‘s digital currency is commonly referred to as the e-CNY. It can be used with an app on your phone or with contactless payment cards, badges, watches and bracelets.

The e-CNY is programmable with smart contract features for automatic payments. Research and development of the main functions is basically complete.

The project has been in its pilot phase for over a year and is being used in ten cities (plus tests in special scenarios like the upcoming 2022 Beijing Winter Olympics).

As of the end of June 2021, there are 20 million retail and 3.5 million business wallets in use. The e-CNY has seen over 70 million transactions, totaling over $5.3 billion dollars.

There are seven major Chinese banks, state-owned mobile telecom providers Unicom and China Telecom, as well as China‘s internet giants Ant Group (owner of Alipay) and Tencent (owner of WeChat) involved.

For now, the e-CNY is focused on domestic retail payment needs.

Of course, it‘s too early to talk about international applications, but I have no doubt that the e-CNY will play a large role in opening up Chinese capital markets to the world. In due time, the e-CNY will likely spread all over Central Asia, Africa and Latin America, alongside the One Belt One Road initiative.

It took the CCP almost 8 years to get to where they are today with the e-CNY. A nationwide roll-out is likely at least two years away.

Arguably, the Chinese are the most efficient in the world when it comes to rolling out new technologies and infrastructure at scale.

After all, they can build complete 10-story apartment buildings in 28 hours or rebuild a gigantic bridge in 43 hours.

So where does that leave the rest of the world?

The majority of the world‘s central banks are researching the potential for CBDCs. But only the Federal Reserve, the European Central Bank, and the Bank of Japan are of significance.

Europe has become a place where business and technology goes to die. The European Union is a bureaucratic monster.

Exhibit one: The GDPR “privacy“ law. A monumental flop. It‘s major accomplishment is tons of useless paperwork and a never-ending flood of annoying pop-ups on websites warning you of harmless cookies.

Exhibit two: The European Union’s Regulation of Markets in Crypto-assets, (MiCA) is already regulating cryptos to death. The EU is increasingly becoming a high-tech wasteland.

Recently, ECB president Christine Lagarde (who seems to have an unhealthy obsession with tanning salons) talked about introducing a European CBDC in four years.

On the other hand, the chairman of the German Bundesbank Burkhard Balz said a more realistic scenario is 2026, the earliest.

Based on the Chinese track record, this seems to me like a more realistic scenario.

In July 2021 the ECB has decided on a 24-month research phase. That‘s the extent of the current plans.

Europe‘s status as a tech laggard can also be seen in stablecoins. While every day more than $100 billion is transacted through USD stablecoins, the amount for EUR stablecoins is close to zero.

In summary, a European CBDC is at least five years away. And that‘s if the European Union lasts another five years. I doubt the EU will survive that long in its current form.

Next, let‘s take a look at the plans of the Federal Reserve in the US.

The Fed has made clear it wants the banking system to retain its central role even after a digital dollar is created. It explicitly wants to protect banks from disintermediation. It sees the CBDC as a mere complement to the status quo.

Exactly what one would expect from a corrupt system with a revolving door between Wallstreet and the regulators.

The Fed‘s first step towards creating a CBDC is rolling out the FedNow service. FedNow is a service for instant clearing and settlement of transactions between banks.

This basic banking system feature has been available in most of the rest of the world for a long time.

In the European Union for example, the SEPA Instant Credit Transfer system went live in 2018.

The American FedNow system isn‘t scheduled to go into production for another two years!

The constipated European Union leapfrogging the US by half a decade, shows how antiquated the US banking system really is.

The Fed‘s approach is the polar opposite of decentralized finance. Together with its snail‘s pace, it will only aid the unrelenting rise of DeFi.

When it comes to a CBDC, the US is many years away from it becoming a reality. And the Fed is nowhere near to the foresight and technical capabilities of China.

Let‘s take a look at the plans of the second largest Central Bank in the world: The Bank of Japan.

Hideki Murai, head of Japan‘s ruling party‘s panel on digital currency recently announced that a decision should not be expected before the end of 2022.

In other words, it‘s unclear as of now if Japan will even develop a CBDC. And should it decide to do so, it‘s many years away from becoming a reality.

In summary, with the exception of The People‘s Bank of China, no relevant Central Bank will have a CBDC ready to deploy in the near term future.

In the meanwhile, the Blockchain Ecosystem is developing at lightning speed. In fact, it‘s growing so fast, it‘s hard to keep up with all the new projects, technologies, token mechanics, and economic designs.

Plus, there‘s an innovative new organizational structure that‘s yet another game-changer: The Decentralized Autonomous Organization (DAO).

Stablecoins are undergoing a rapid evolution and I‘m keeping a close eye on new developments.

But before I tell you about the future of money and how you can become financially self-sovereign and avoid the CBDC nightmare, I want to clear up a common myth about bitcoin.

The Bitcoin Is Money Myth

Bitcoin was initially intended to be a “peer-to-peer electronic cash“ system.

That was an ambitious goal for the first iteration of a brand new technology.

The reality is that Bitcoin falls short in this regard. It‘s an excellent store of value and will keep taking away market share from gold. As a permissionless and censorship-resistant transfer mechanism for capital, it‘s second to none.

But for everyday transactions, its design limitations are preventing it from ever becoming money.

Bitcoin has neither the capacity, nor the rapid transaction finality, nor low enough fees for this to be possible.

Its pseudonymous nature also lacks the privacy needed for electronic cash.

So what will the money be in the future?

The Rise Of Crypto-Native Stablecoins

CBDCs are completely centralized and to be avoided at all costs as I have outlined above. They are quite literally the opposite of decentralized cryptocurrencies.

Satoshi Nakamoto killed the legacy financial system before anyone knew what happened.

His invention of digital scarcity made possible permissionless transactions without middle-men that cannot be censored.

For the legacy financial system, that‘s like a bite from a Dandarabilla - as soon as it happens, you‘re already dead, reality just has to catch up with the fact.

The old, corrupt system is many years away from attempting to launch a counterattack with CBDCs. In the meanwhile, the crypto dandarabilla is spreading its deadly venom and has practically already killed its archaic opponent.

Right now, well over $100 billion is being transacted within the Blockchain Ecosystem in the form of stablecoins every single day.

A stablecoin is a coin that exhibits low or zero volatility to some reference asset, typically the USD.

The most popular stablecoins are USDC by Circle, USDT by Tether/Bitfinex, BUSD by Binance plus a long tail of smaller players.

The problem with these stablecoins is that they are either fully or partially backed by dollars in the banking system.

So, not only do they depend on a link to the legacy financial system and are not censorship-resistant, but as the Fed is following the Banana Republic playbook and keeps printing trillions of additional dollars, these stablecoins are becoming increasingly less stable over time.

This is where crypto-native stablecoins come into the picture. They cut the umbilical cord to the legacy financial system.

There is no government risk. They exist on decentralized and distributed networks so they cannot be censored, confiscated or shut down.

They can also not be inflated at will, thereby protecting your purchasing power.

Instead of being backed by dollars, they are backed by assets from within the Blockchain Ecosystem.

This can be a mix of crypto tokens that could be backed by bandwidth, network effects, computing power, intellectual property, valuable data, storage capacity, and so on - basically the economic value within the Blockchain Ecosystem - as well as tokens representing commodities, companies, real estate and other real world assets.

As various crypto coins gain adoption and value, and as more and more real-world assets are being represented on blockchains, crypto-native stablecoins will become more and more resilient.

In addition, there are a number of automatic, programmatic stabilizers that help to balance and keep prices in line.

So what is now beginning to emerge is a crypto-native unit of account that is value-stable but floats freely without any ties to fiat currencies.

There are several promising projects that are rapidly gaining traction. I think that within 1-2 years we‘ll have one, if not multiple, viable alternatives to fiat-backed stablecoins.

Rapid advancements in the field of zero-knowledge proof cryptography will bring complete privacy not only to these crypto-native stablecoins but to the entire Blockchain Ecosystem.

Add to that the cryptographic tool of bulletproofs and even the transaction amounts become completely invisible.

This means you‘ll be able to send money to someone, without anyone else knowing who sent money to whom and not even the transaction amount is known. At the same time, everything is guaranteed and verifiable on a public blockchain.

Soon you‘ll be able to use crypto money that is stable, completely private and totally immune from government interference.

This new form of money will be ready for mass adoption years before Central Banks are in a position to roll out their totalitarian shitcoins.

And it gets even better...

A Unified Payment Mechanism

There‘s a blockchain project I‘m following that enables anonymous transactions and bartering with any coin. It‘s completely asset-agnostic and even works with multiple parties.

In other words, it‘s a settlement layer that allows you to pay for goods and services with any coin you might already have (even NFTs). And it makes any coin that is transacted through its network a privacy coin.

The general population is slowly waking up to the fact that cryptocurrencies are a thing, that they are growing and cannot be stopped.

Total privacy is coming to all transactions and the entire Blockchain Ecosystem. The same properties of being permissionless and uncensorable that guarantee the continued rise of blockchains also ensure unstoppable progress when it comes to privacy.

That means privacy is inevitable. It‘s simply a bit too early to be mature technology and commonplace, but it‘s only a matter of time until it is.

The new world of crypto money offers multi-dimensional improvements over the corrupt, inefficient and slow legacy financial system.

And as Central Banks around the world continue to print trillions of currency units and inflation continues to rise, a well selected portfolio of cryptocurrencies is by far the best strategy to protect your purchasing power and grow your capital.

A New Social Order Is On The Horizon

Completely anonymous, permissionless, censorship-resistant, crypto-native stablecoins that are almost free to use will form the backbone of the coming Second Renaissance.

After the dark period of the Middle Ages, the Renaissance saw the separation of State and Church. This happened in large part thanks to a new technology:

The printing press.

Earlier challengers to papal authority had little ability to circulate their ideas to a wider audience.

It was the technology of the printing press that allowed Martin Luther to disseminate his ideas in thousands of printed books and pamphlets.

The power of this new technology eventually led to widespread reforms and a change to the social order.

We are now on the cusp of yet another change to the prevailing social order.

A Second Renaissance is coming.

This time around, blockchain technology is the catalyst.

We now have private money completely outside of the control of governments. There‘s no way for a government to directly interfere.

That‘s why one of the key pillars of the Second Renaissance is the separation of State and Money. This process is now in its infancy.

Once the Blockchain Ecosystem is sufficiently developed in its technology, infrastructure and mind share among the population, we‘ll shed the existing totalitarian power structure that‘s plaguing humankind, get rid of the nation-state and enter the Second Renaissance.

The Second Renaissance will be a period where humanity‘s creativity and entrepreneurial force will be truly unleashed, leading to a completely new social structure, untold scientific and technological advancements and growing wealth for everyone.

The Second Renaissance will bring sovereignty to the individual.

And here‘s the best part: You can help to bring about this opulent reality of abundance. And if you do, you‘ll be richly rewarded.

How so?

Exit the legacy financial system of oppression now and join the peer-to-peer revolution.

Take the Crypto Quantum Leap and become self-sovereign with your finances.

And if you want to take your wealth to the next level, learn about Project Serenity to fully capitalize on the biggest shift of wealth in human history.

To sovereignty and serenity,

Marco Wutzer